Okay, I was trying to figure out how to invest my HSA Bank funds through TD Ameritrade and couldn’t find ANY clear steps, so I figured it out on my own and am here to save you the headache!

Below, you’ll get step-by-step instructions with screenshots. But first, let’s go over two common questions when it comes to investing HSA funds.

Does TD Ameritrade offer health savings accounts?

No, TD Ameritrade does not offer Health Savings Accounts, but they DO offer Health Savings BROKERAGE accounts. You must FIRST open a Health Savings Account (HSA) with a bank and THEN you can open an HSA brokerage account with TD Ameritrade.

Here’s how I can best explain it: There are TWO pieces of the HSA investing aspect:

- HSA account. This is a Health Savings Account, which is JUST like any bank savings account, BUT the savings can ONLY be spent on qualifying health expenses.

- HSA brokerage account. This is just like any brokerage account, which is where you invest money in the stock market, BUT the funds that you invest and transfer can ONLY be to and from your Health Savings Account.

So, basically, you need an HSA AND an HSA brokerage account to invest your HSA funds.

Here’s how I do it:

- I have an HSA account with HSA Bank.

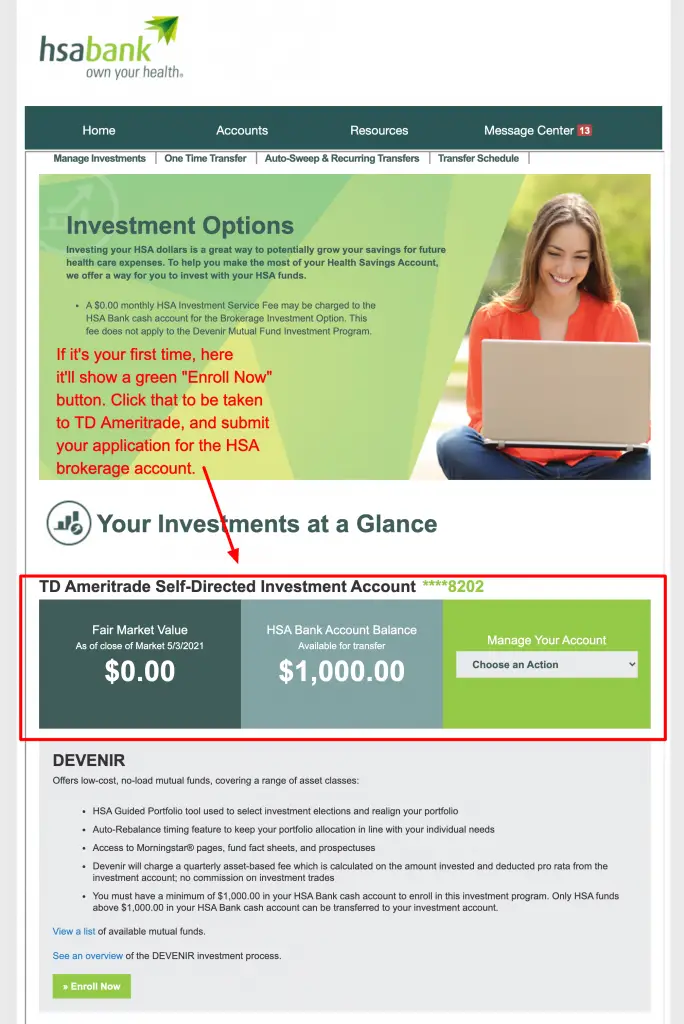

- I then opened an HSA brokerage account with TD Ameritrade. You can ONLY do this AFTER you open the account with HSA Bank AND fund it over $1,000. That’s because you can only invest the amount OVER $1,000 from HSA Bank. HSA Bank does this because they want you to have SOME cash (at least $1K) in your savings account in case you need to spend it immediately on health expenses.

How do you invest your HSA funds?

To invest your HSA funds, you must link your HSA to a brokerage account. An HSA is just a bank savings account. If your money is sitting there, it’s earning practically nothing but a teeny amount of interest each year. The best way to make more money is to INVEST your HSA funds through a brokerage. Basically, you transfer money from your HSA to your brokerage account, where you then buy and sell stocks.

How to Invest HSA Bank Funds Through TD Ameritrade: Step-By Step Instructions

Step 1: Contribute at least $1,000 to your HSA Bank account.

With HSA Bank, you only have the option to invest your funds once you’ve contributed at LEAST $1,000. You can invest any amount over $1,000 (in other words, you must have a minimum of $1K sitting in your HSA Bank savings account at all times.

Step 2: Link your HSA with TD Ameritrade.

To do this, you must submit an application for a TD Ameritrade brokerage account. You will do this through your HSA Bank dashboard.

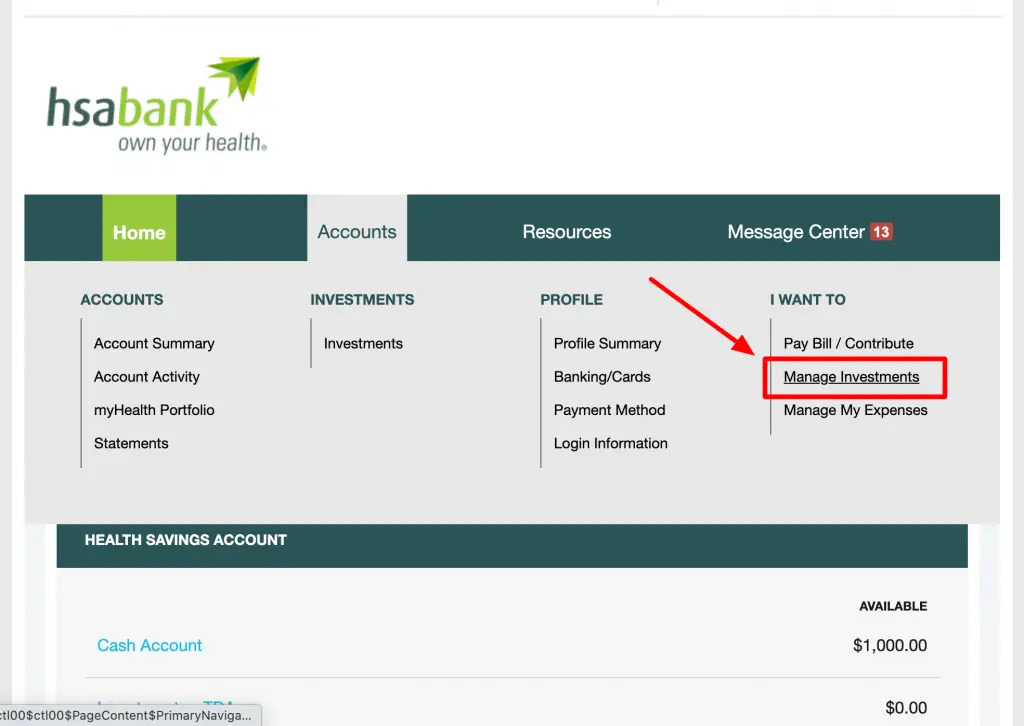

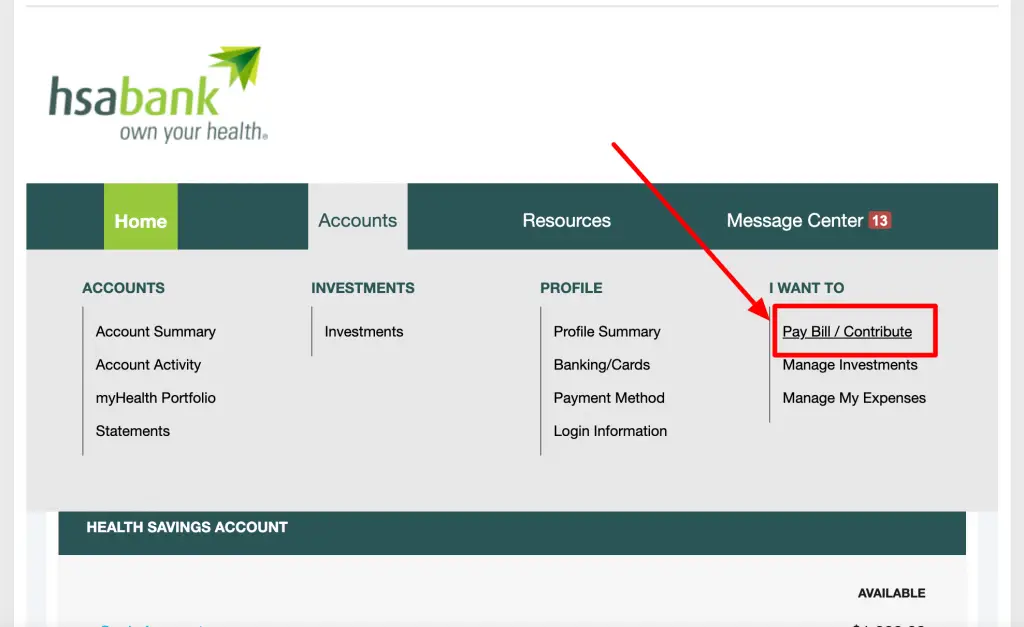

2a. Log in to your HSA Bank account.

2b. Hover over “Accounts” and then click “Manage Investments.”

2c. You’ll see a screen that says “Investment Options.” Scroll down and click “Enroll Now” under TD Ameritrade.

2d. You’ll be taken to the TD Ameritrade application. Fill it out and submit it.

Step 3: Create login info for TD Ameritrade HSA brokerage account.

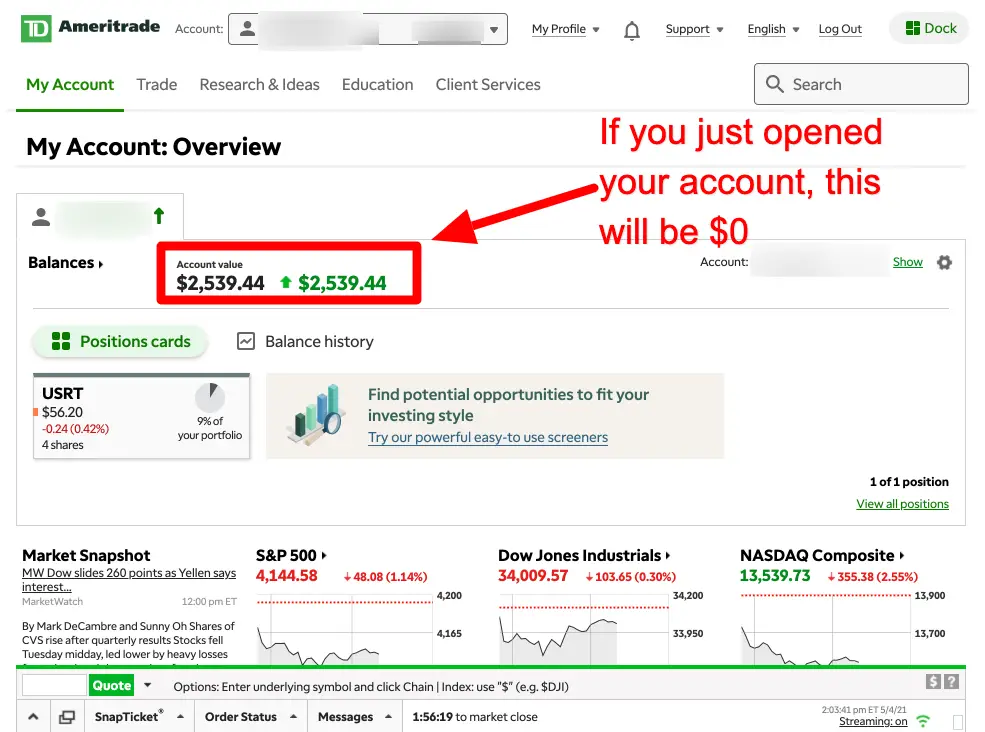

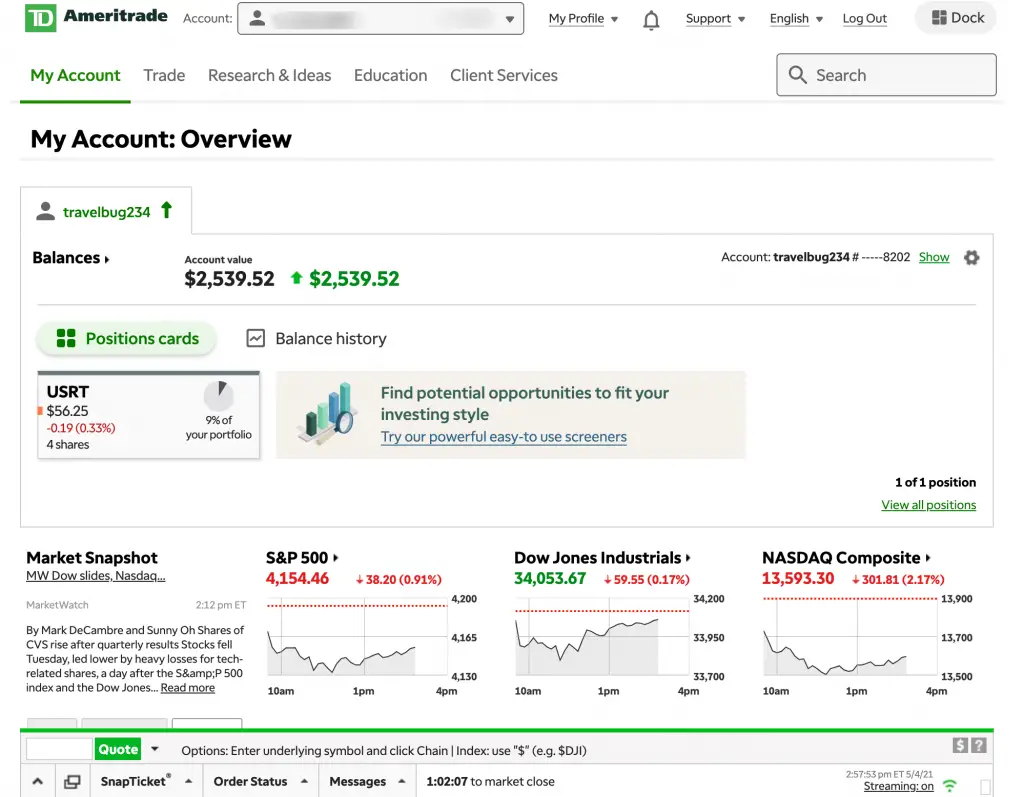

Once you’ve submitted your application, you’ll be prompted to create a login for your TD Ameritrade account. Then, this is what you’ll see in your TD dashboard:

Step 4: Transfer funds from HSA Bank to TD Ameritrade.

Now, switch tabs and go back to your HSA Bank dashboard.

4a. Go to your HSA Bank dashboard and hover over Accounts” and click “Pay Bill/Contribute”

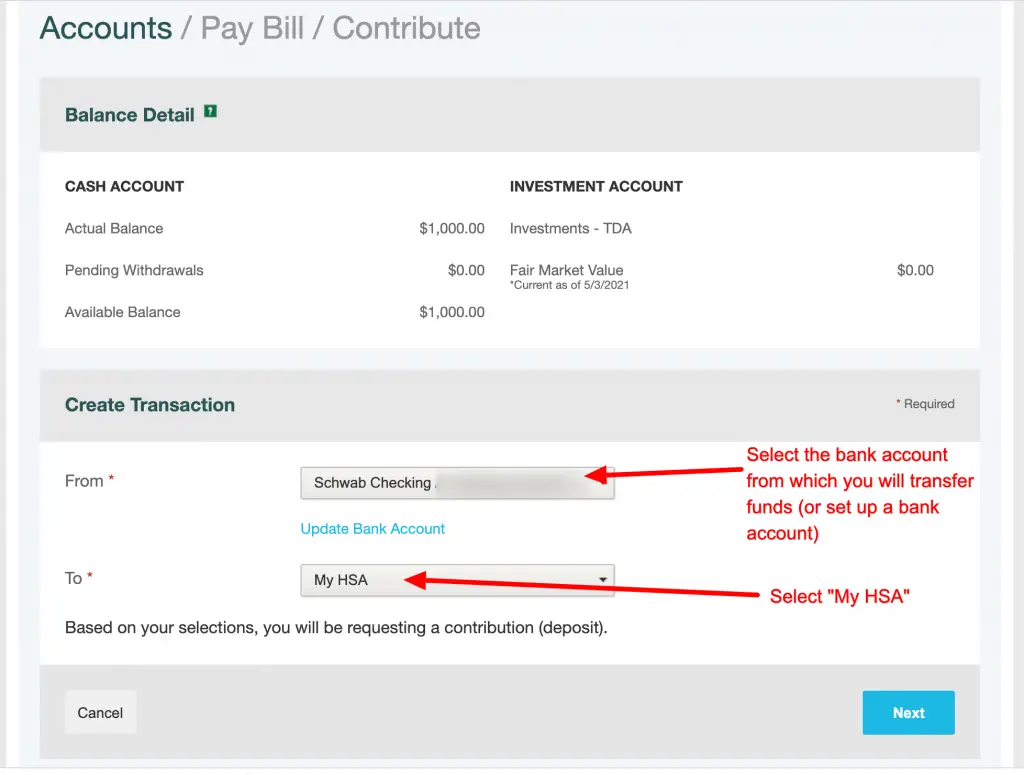

4b. Set up the bank account FROM which you will transfer funds TO your HSA

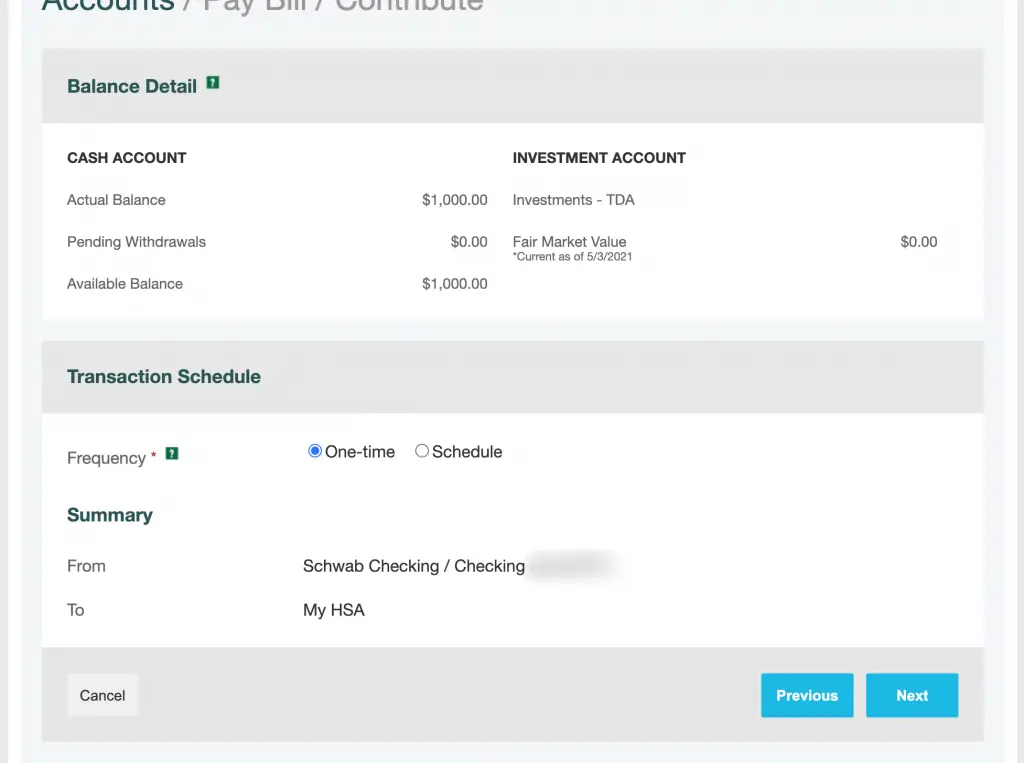

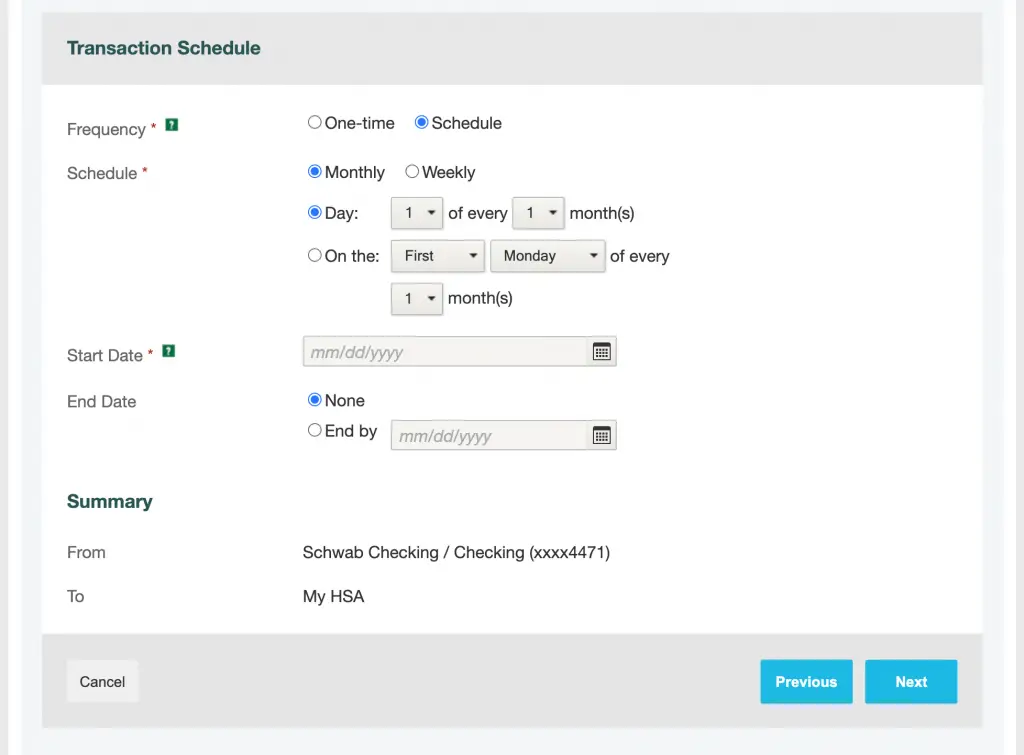

4c. Select “one-time” or set up recurring transfers.

You can do a one-time transfer (which I’ll show below) or you can schedule recurring transfers.

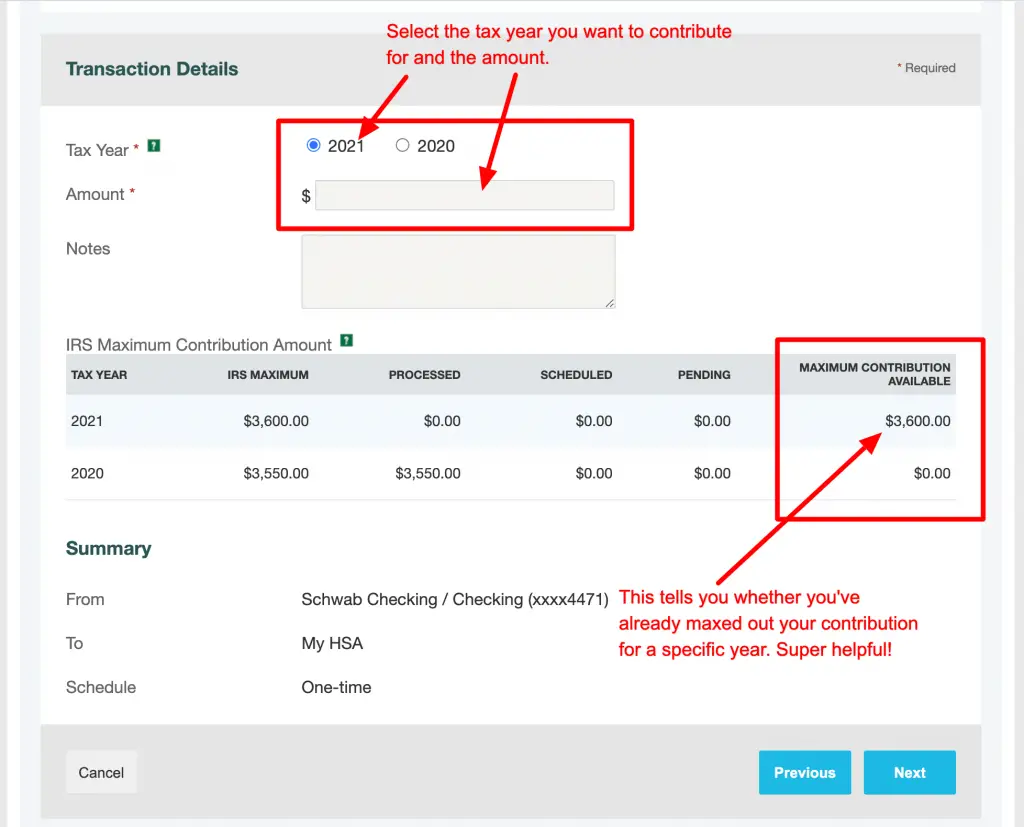

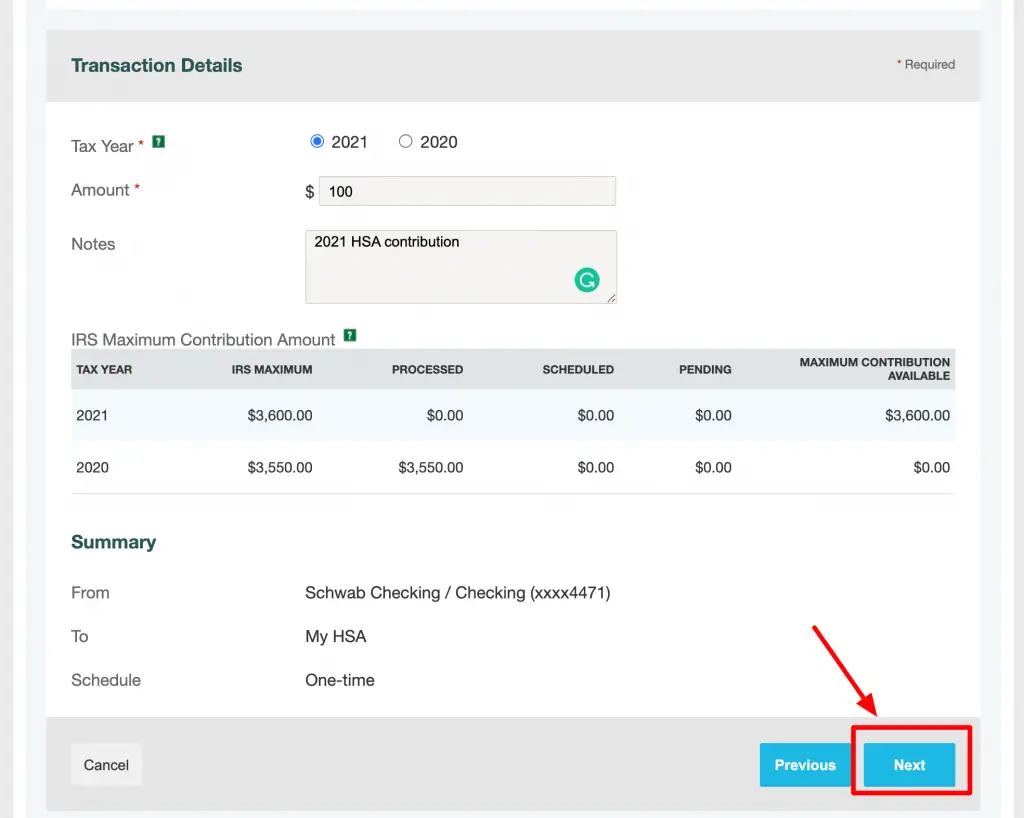

4d. Select the tax year and the amount you want to contribute. Click “Next.”

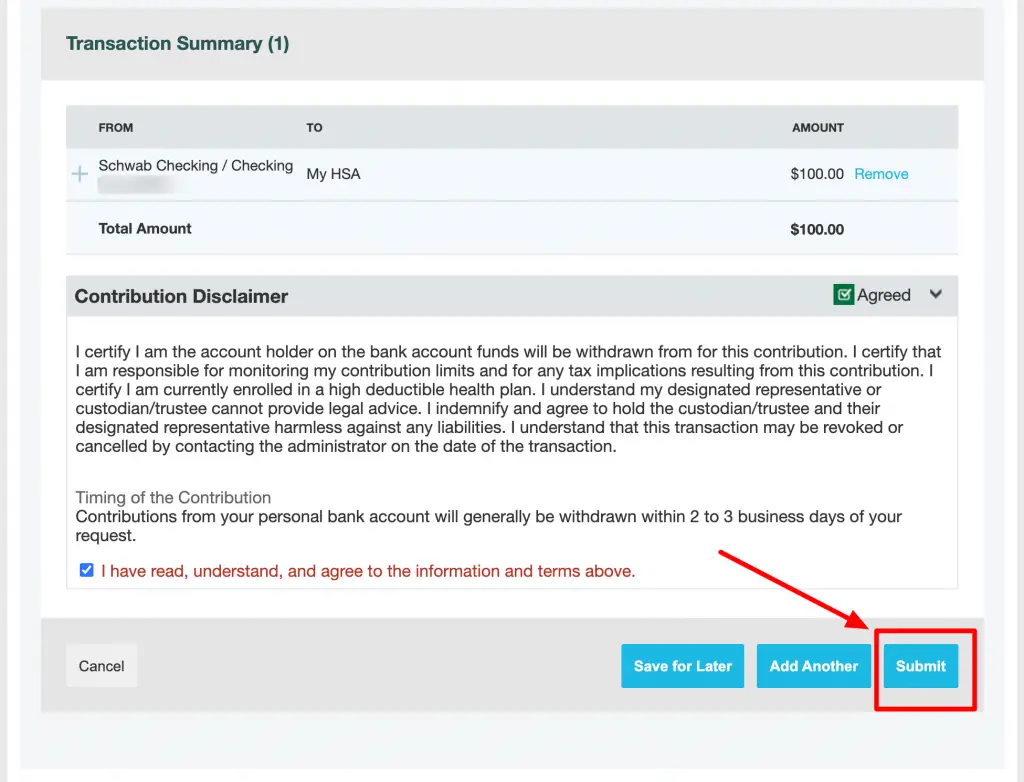

4e. Submit your transfer.

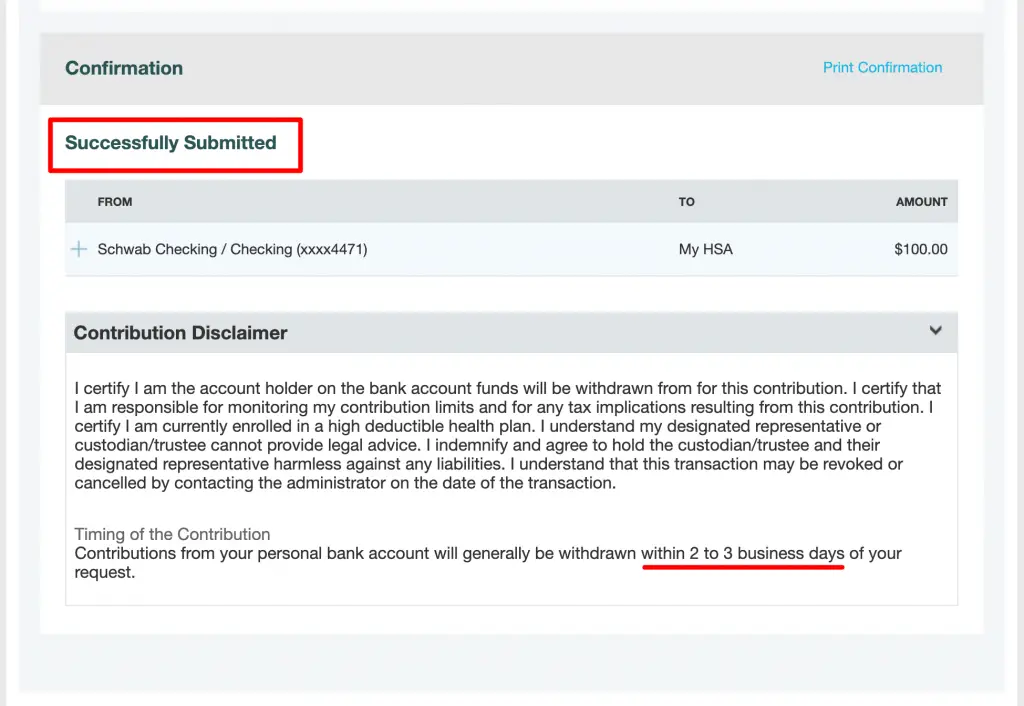

4f. Success! Now, wait 2 to 3 business days for the funds to post to your TD Ameritrade brokerage account.

Step 5: Place an order on TD Ameritrade.

Once your HSA funds have posted to TD Ameritrade, you can invest them!

Log in to your TD Ameritrade account. Here’s what mine looks like.

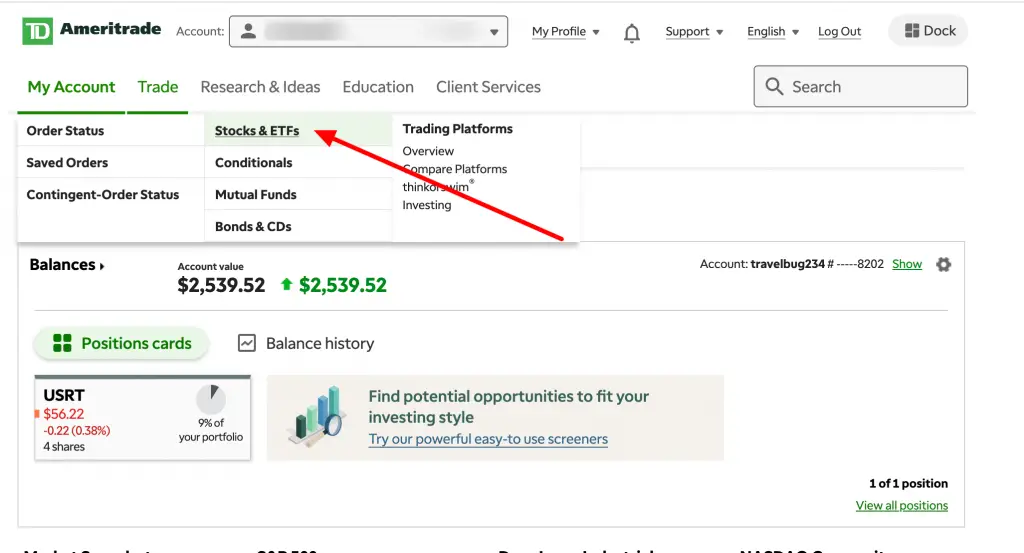

Hover over “Trade” and click “Stocks & ETFs”

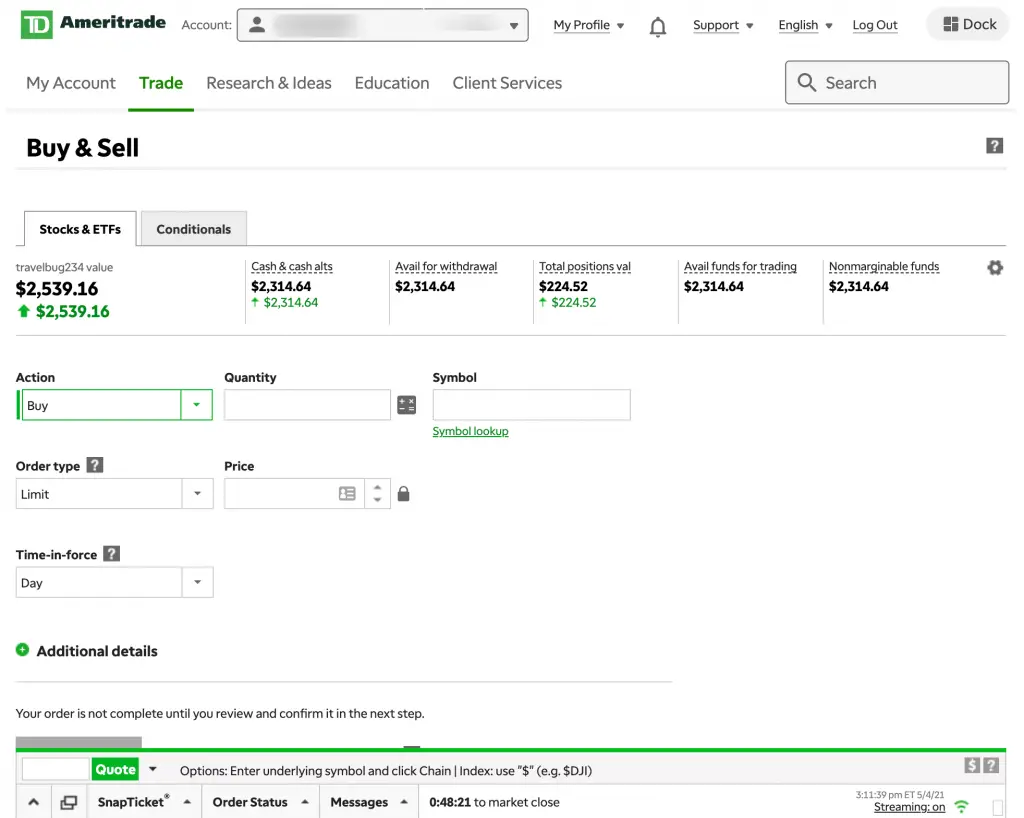

Learn the lingo:

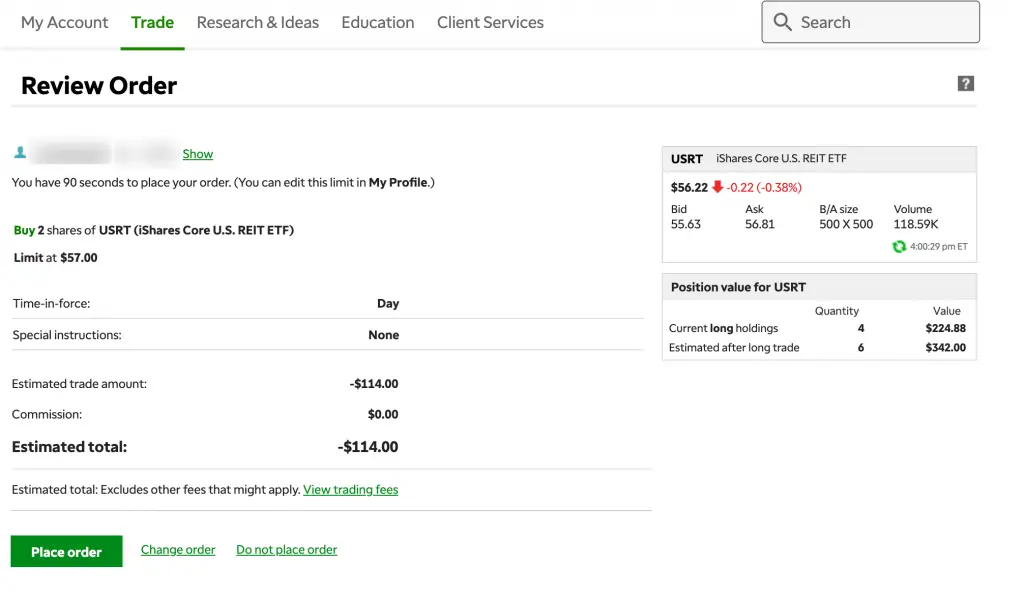

- Order Type: “Limit” means you will set a maximum price that you’ll buy each share at. “Market” means you want to buy the stock immediately—no matter what the price is. I recommend placing a “Limit” order because you never know if a stock is going to shoot up and you end up paying more for it than you wanted.

- Time-in-force: “Day” means the order will take place during that trading day. After that, it’ll be canceled if the stock price doesn’t fall within your limit that you set.

- Quantity: How do you know how much to buy? Simply enter a quantity and a limit and it’ll calculate the estimate for you. Otherwise, you can do the math yourself. Let’s say you have $100 in your available balance, and you want to buy stock at $50 each. Then, you can afford to buy 2 of that stock ($100 total).

- Symbol: This is the the set of letters that represents your stock on the stock exchange. I purchased USRT, which is iShares Core U.S. REIT ETFs.

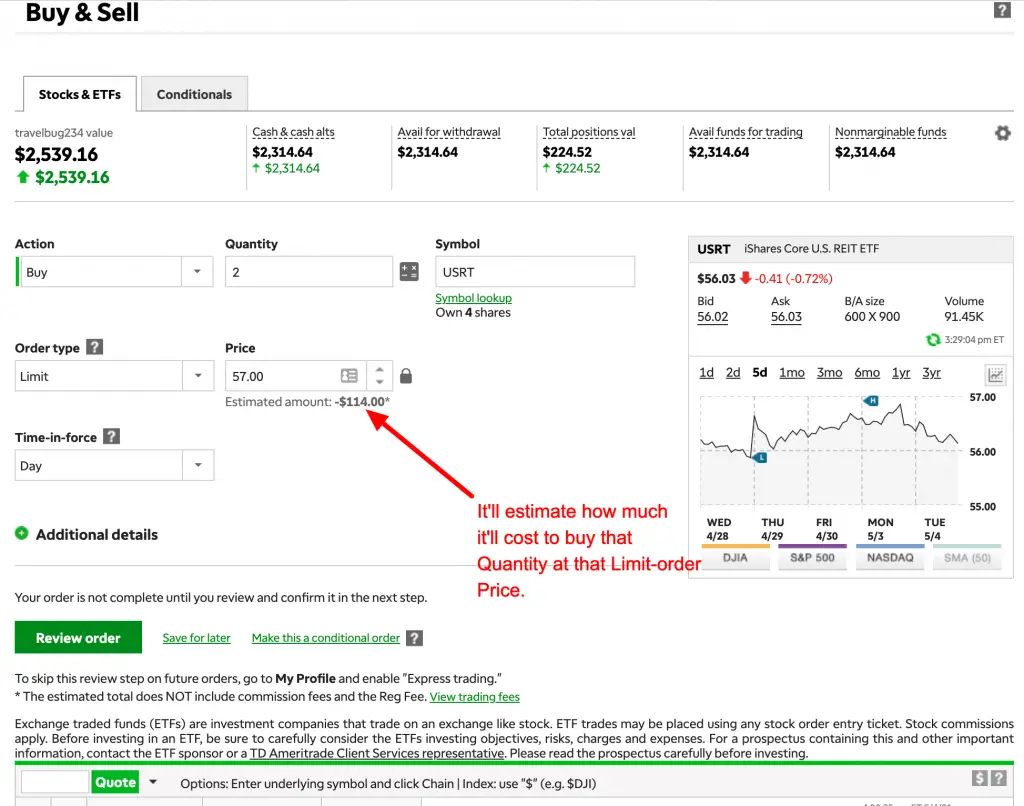

So, here’s my real-life order:

Click “Review order.“

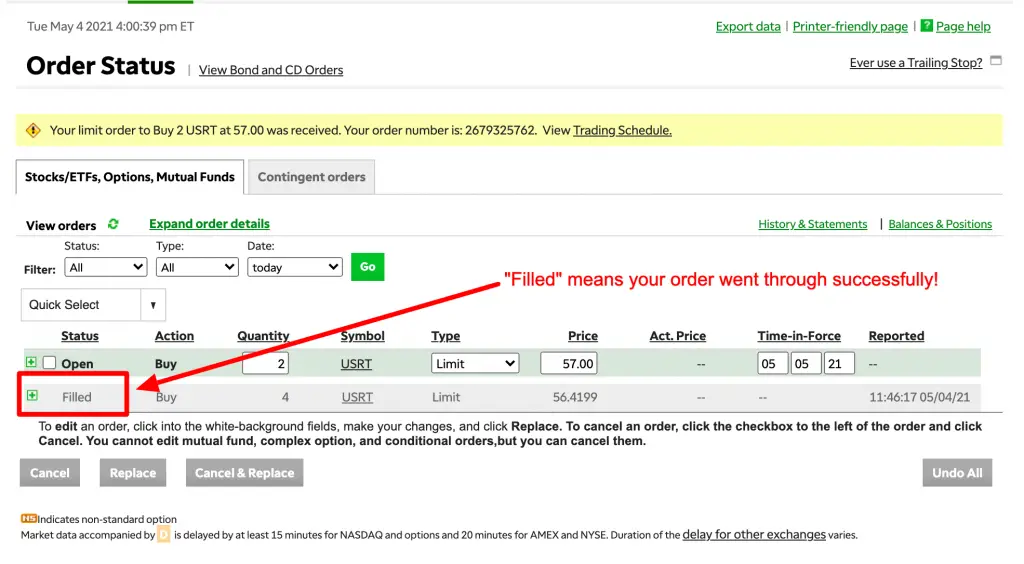

Click “Place order“

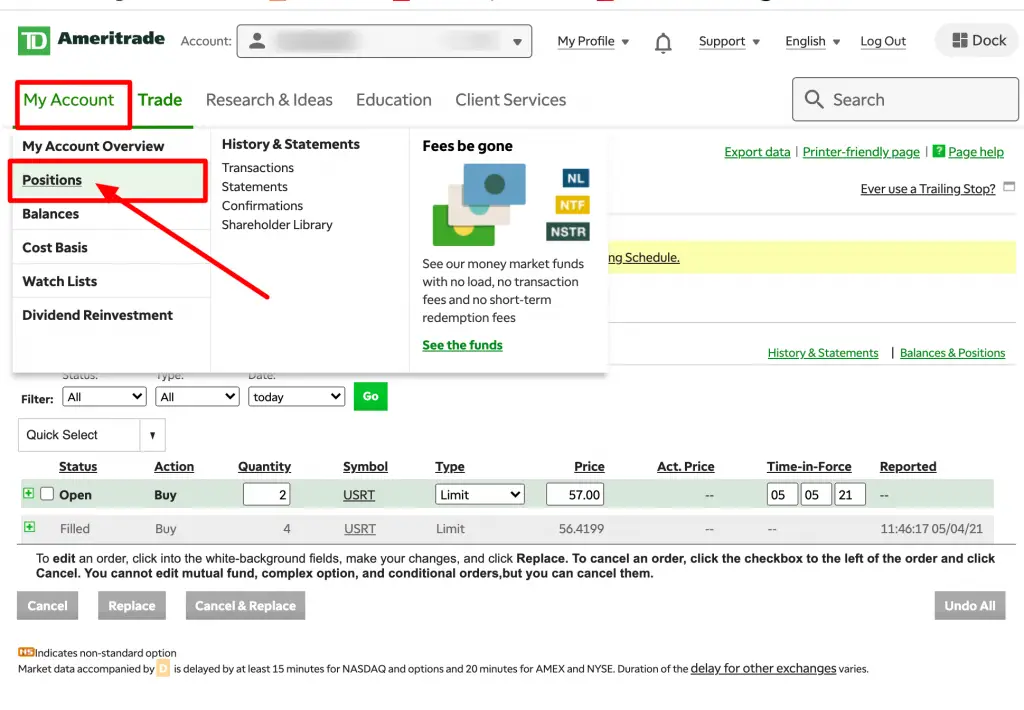

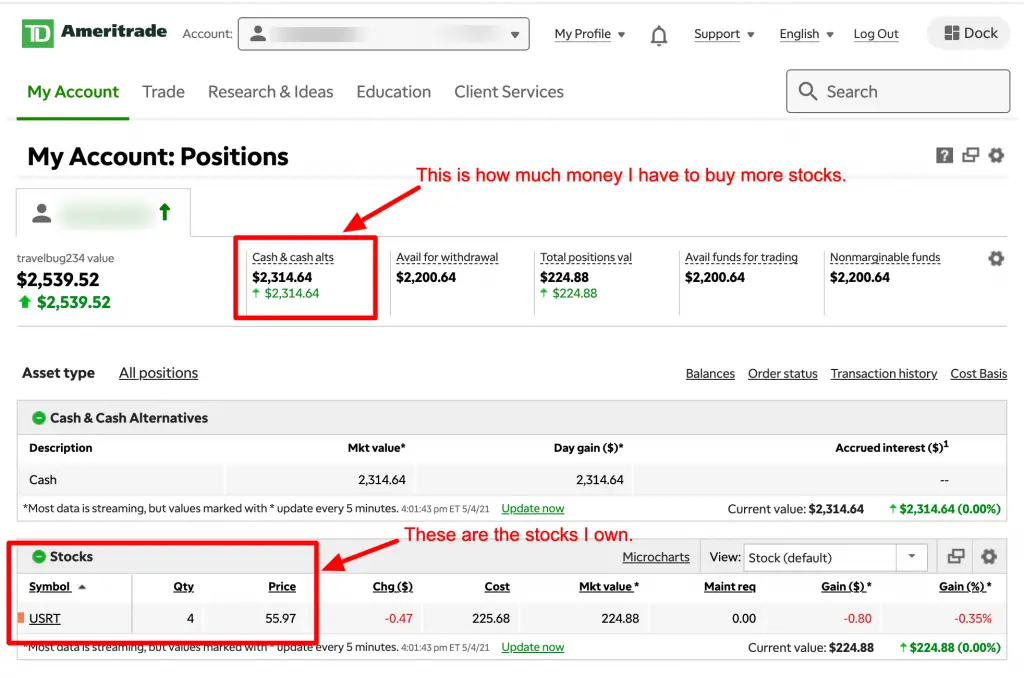

To see your account, hover over My Account and click Positions.

As you can see, investing your HSA funds with Ameritrade is simple once someone shows you how to do it!