No one ever wants a bill to go to a collections agency. But what happens if it does…and you had NO idea you even owed a debt?

Yep, that happened to me.

Disclaimer: I am NOT a financial advisor and the following is not financial advice. I am just sharing my personal experience. Always seek advice from a qualified professional before making major financial decisions.

Here’s the story: Back in May 2019, I moved out of my apartment in Florida. At the time, my power company was Duke Energy, and since I was moving out, I had to cancel my account. That was an easy phone call that took a couple of minutes. I thought that was the end of it, and I moved out without looking back.

Big mistake.

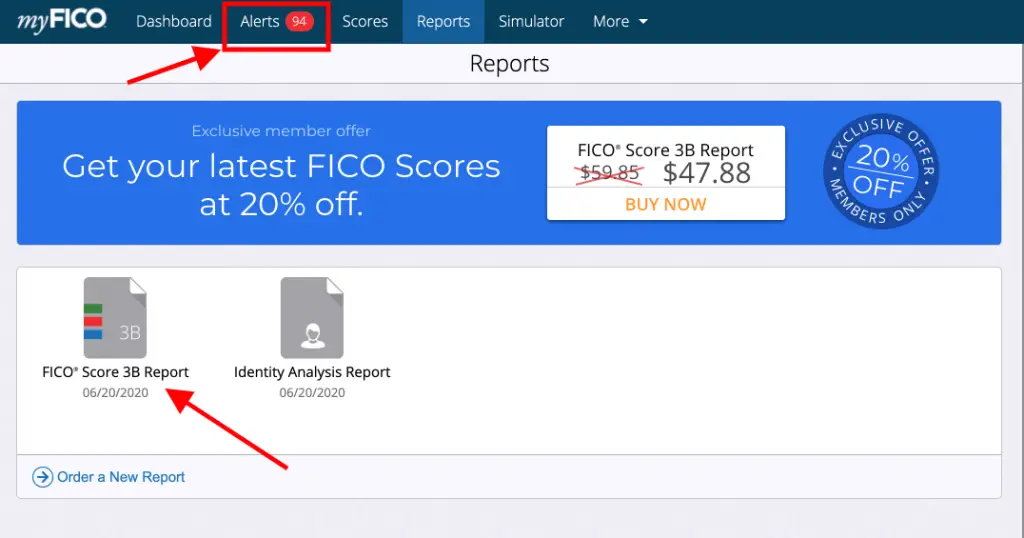

One year later, in June 2020, I decided to check my credit report on MyFICO.com. I do this on occasion to ensure there are no suspicious or fraudulent items and ensure my credit score is looking healthy.

As background, I’m extremely conscientious about my finances, especially my credit score, since it can dictate whether you can rent an apartment or get the best mortgage rate. My credit score is typically around 780.

So imagine my shock when I logged into MyFICO and saw that my Equifax score was 677!

Cue the panic.

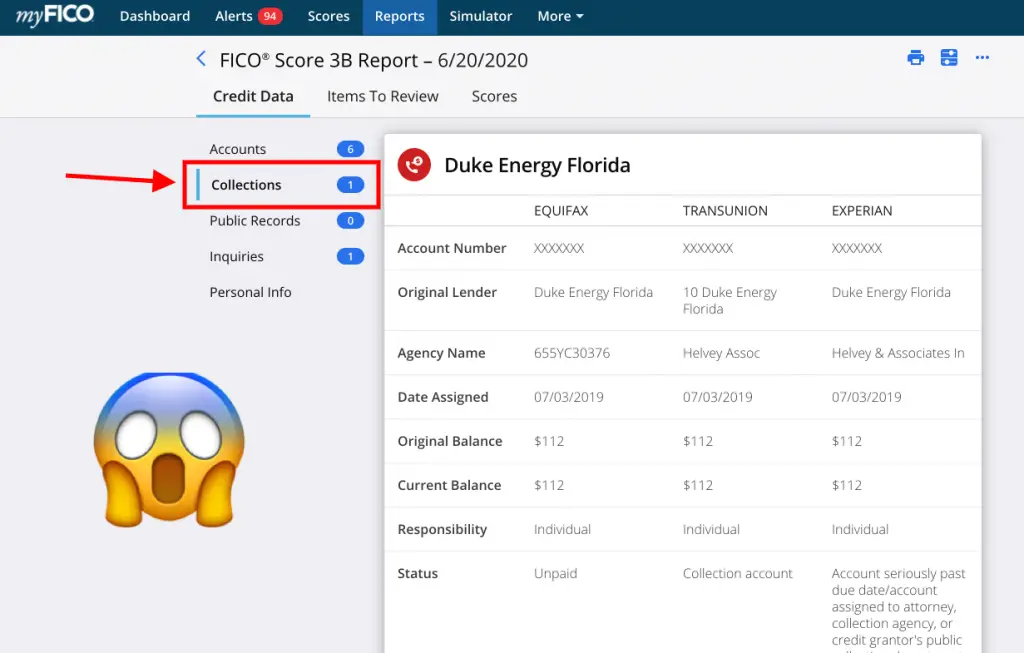

I went to the Reports tab of MyFICO and checked the credit report. Sure enough, there was a notice on the Collections tab.

It looked like I hadn’t paid a Duke Energy bill (even though I thought my account was paid off when I closed it a year ago). It also looked like my debt had been assigned to a collections agency named Helvey & Associates.

Over the past year, I never received ANY mail or phone calls from Duke Energy nor Helvey & Associates.

I immediately searched my emails for notices from Duke Energy. I had been signed up for online bill pay, and they always sent me an email when a bill was due. But when I tried to log into my old Duke Energy account, it said it no longer existed.

Here’s what I was able to piece together: Apparently, when I closed my account with Duke Energy, I still had money due on it, and I failed to pay it. I assumed Duke Energy would’ve made me pay off the remaining balance BEFORE I canceled the account, but they didn’t. Then, once the account was closed, Duke Energy stopped sending me email notices of a balance due.

Further, when I moved out of that apartment, I failed to notify Duke Energy of my NEW mailing address. So…if they had been sending notices, they had gone to my OLD apartment address, so of course, I never got them.

As for the phone calls, I guess neither Duke Energy nor the collections agency is required to call you. They are required to at least notify you by mail, but again, they had my old address.

In fact, according to The Balance, a debt collector is only required to make “initial communication” with you—whether that’s via phone call or snail mail is up to the debt collector:

However the collector chooses to contact you about the debt for the first time is the initial communication. It can be a phone call, a letter, or even a summons to appear in court. The initial communication should include how much you owe, to whom, and other pertinent information. The debt collector must also notify you, in writing, of your debt validation rights within five days of its initial communication to you

The Balance

Trying to Get Rid of a Collections on My Credit Report

At this point, I was DESPERATE to get the collections item removed from my credit report, so I started Googling.

How to dispute collections with a credit bureau

I came across SO much advice saying that under no circumstances should I contact the collections agency myself. I also read that I could dispute the debt with the credit bureau.

However, here’s the rub: I was pretty sure I owed the debt. It was my mistake. So I had no right to dispute something that was correct, even if I felt it was unfair that no one ever called me. So, I decided not to go this route.

Duke Energy collections pay to delete/goodwill deletion

I also read that I could call Duke Energy myself and ask them if they’d offer a “pay to delete” or “Goodwill deletion.” This means that if I pay off the debt, they will delete the item from my credit report.

I tried this. But here’s the problem: At the point at which your debt has been sold to a collections agency, Duke Energy no longer owns it. You don’t pay Duke Energy. You pay the collections agency. Duke Energy also told me that they do NOT delete items from your credit report. So this was useless.

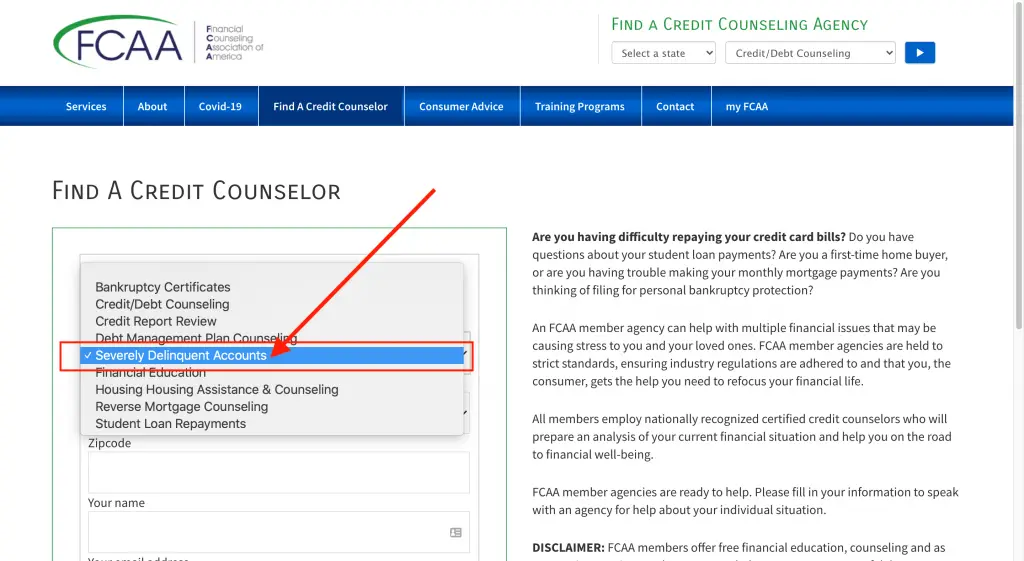

Contact a consumer advocacy group to help you with debt collections

Did you know that there are consumer advocacy groups out there who help you with debt collectors and give general financial advice for FREE? This option was useful because they offered me expert advice without me paying a dime.

I filled out this contact form on the Financial Counseling Association of America (FCAA), and a credit counselor contacted me by phone and gave me free advice on what to do about my debt in collections. Her advice? Just pay it off in full as soon as possible.

However, your situation may be different! Before you do ANYTHING, I recommend talking to a consumer advocate to get advice pertaining to your unique situation.

How long does a collection stay on your credit report?

According to Experian, “seven years from the original delinquency date of the original debt, or the date of the first missed payment after which the account was no longer brought current. “ When you pay off your debt with a collections agency, they report to the credit bureaus that the collection status is now “paid” (instead of “unpaid”), but the collection will remain on your report for up to seven years.

Calling Helvey & Associates to Pay My Debt

I called Helvey & Associates and was greeted with “This communication is from a debt collector. This is an attempt to collect a debt and any information obtained will be used for that purpose.”

The woman who answered the phone was cordial. I explained my situation and asked her why I never received any notice about my debt. She informed me that they didn’t have a forwarding address on file, so the collections notice went to my old address (which explains why I never got it).

She also told me, “We’re not required to do phone calls.” Which explains why I never received a phone call about it.

At this point, I decided to try to negotiate with Helvey & Associates to see if they would delete the debt from my credit report.

Can I Negotiate with Helvey & Associates to “Pay for Deletion”?

No. Everything I have read from other people says Helvey & Associates will not remove the collections from your credit report—and it was true for me too.

When I asked the woman on the phone if they’d remove the debt from my credit report if I paid in full today, she told me, “We don’t remove an item from a credit history because we are required to report accurate info to credit bureaus.”

This seems fair, in my case. I failed to pay my debt, and the debt reported on my credit report from the collections agency was accurate. It stinks, but it was accurate.

I decided to go ahead and pay the debt off in full, since there was no point in disputing an accurate debt that I failed to pay. It would just keep hurting my credit score. The sooner I paid it off, the sooner the 7-year countdown to getting it removed from my report could begin. 😭

What Happens When I Pay Helvey & Associates?

To pay off your debt with Helvey & Associates, you have four options:

- Mail a check – No fee

- Mail a money order – No fee

- Pay over the phone with a credit/debit card – This incurs a $4.95 transaction fee from the third-party processor that Helvey & Associates uses: PaymentVision.

- Pay online – This incurs a $4.95 transaction fee from the third-party processor that Helvey & Associates uses: PaymentVision.

Important note about paying with credit card: The Helvey & Associates employee told me that if I paid over the phone with my credit card, my credit card company would likely charge me a cash advance fee. (It’s just a weird thing that happens because of the way the credit card company categorizes Helvey & Associates.)

The credit card I paid with was a Chase Sapphire Reserve card, and Chase has excellent customer service, so I wasn’t worried about getting the fee refunded. Sure enough, a few days later, the payment to Helvey & Associates showed up on my Chase statement as a cash advance, and I was charged a $10 cash advance fee by Chase. I called Chase customer service, and they instantly refunded me the fee!

So just be aware that this might happen, and depending on your credit card company, it may or may not be refunded.

When I gave the employee my credit card details, she very professionally read off the amount of the charge to my credit card and informed me that it would occur on the date June 24, 2020. She also said if I had any questions or wanted to revoke the authorization, I could call Helvey & Associates Monday-Friday from 8am to 9pm or Saturday 8am to 5pm. She also gave me a tracking number for my payment.

What Happened to My Credit Report and Credit Score After I Paid Off My Delinquent Debt with Helvey & Associates

I paid Helvey & Associates on June 24, 2020.

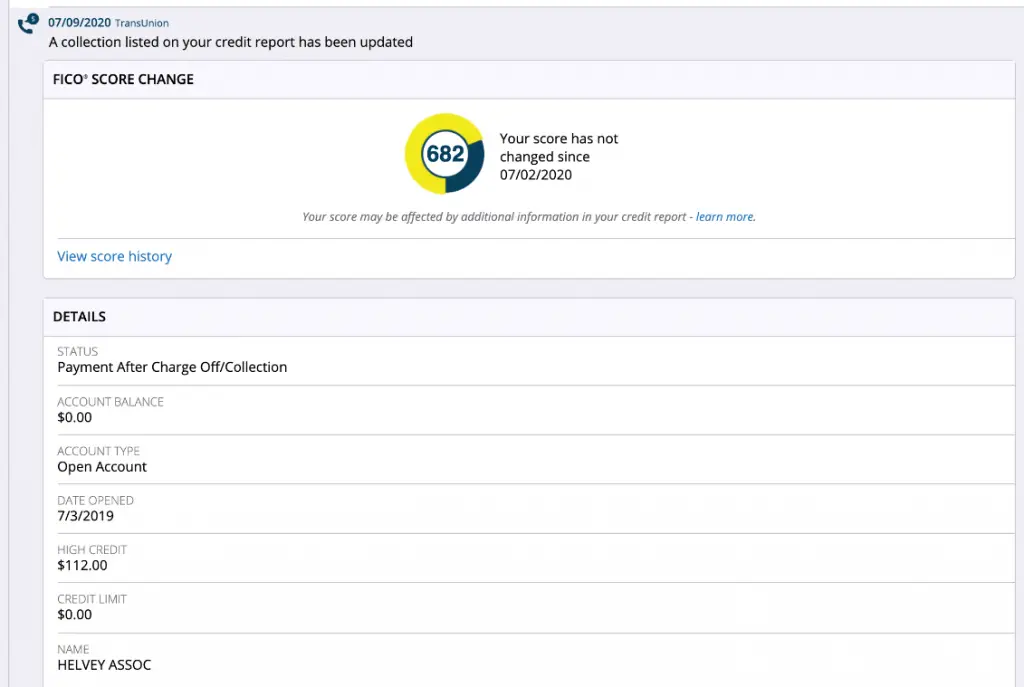

On July 9, 2020, MyFICO.com notified me that TransUnion had updated a collection listed on my credit report.

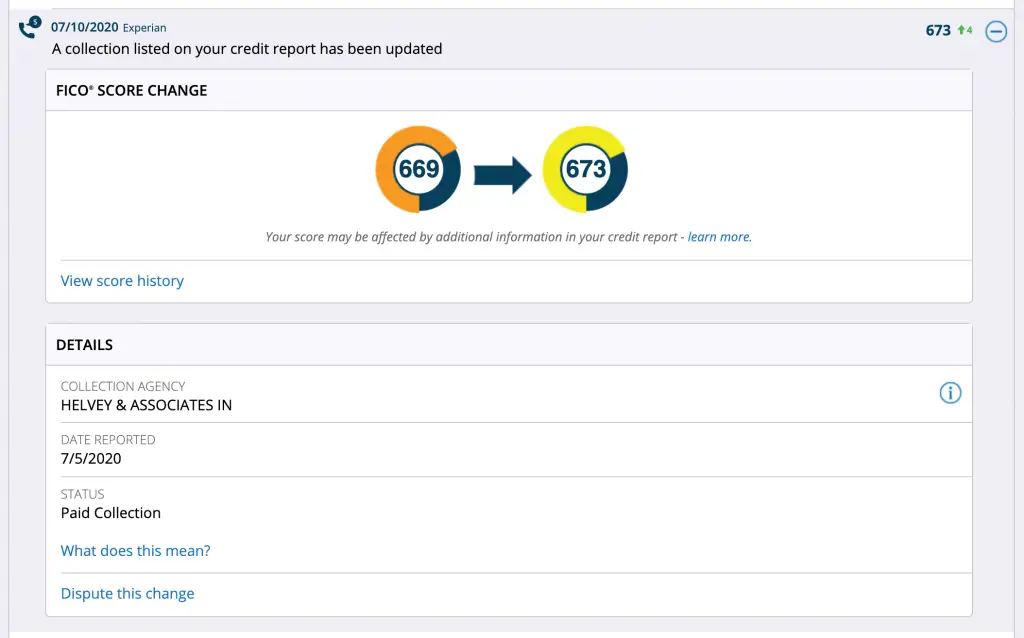

On July 10, 2020, Experian updated my credit reported and changed the status of my collection from “unpaid” to “paid.” As you can see below, that instantly boosted by credit score by 4 points.

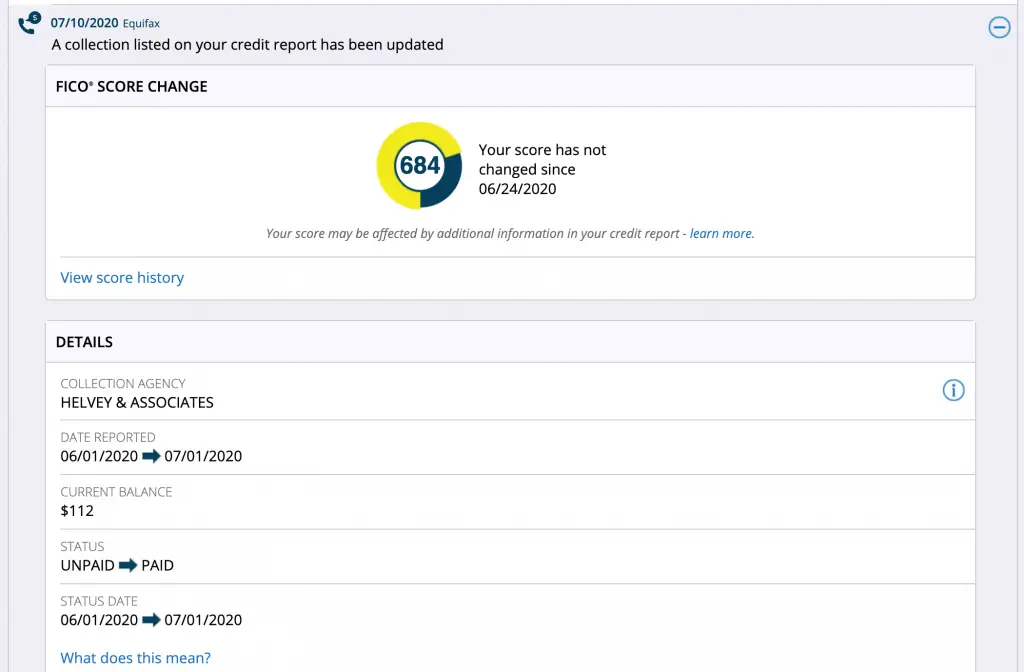

On July 10, 2020, Equifax updated my collection status from “unpaid” to “paid” as well.

Also, when I called Helvey & Associates, I gave them my updated address and they mailed me the notice about my debt to my new address (even though I had already paid it off). It was nice to have a physical record of the notice.

How soon after I pay a collections agency will my credit score recover?

Well, for me, it’s been two months since I paid off my debt with the collections agency, and my credit score has risen by about 15 points with Equifax, 6 points with Transunion, and 4 points with Experian. So, it’s slow. 🙁 I’m hoping to get back into the 700s by the end of the year.

Remember, the collections history has not been removed from my credit report. It’s still there. It’s just now showing up as “paid” instead of “unpaid.” It may be seven years before it’s deleted from my report entirely.

Wrapping It Up: What to Do When a Bill Goes to Collections

Step 1: Determine if it’s legitimate and accurate.

Review your payment history with the creditor and see if you genuinely did forget to pay the bill. If the collection is accurate, then there’s probably no use disputing it. But if it is inaccurate, you might be able to successfully dispute it.

Step 2: Talk to a free credit counselor or consumer advocate.

Contact a consumer advocacy group that gives free advice regarding delinquent accounts.

Step 3: Even if the debt is accurate, it never hurts to ask both the creditor and the collections agency to delete it from your credit report.

Even though doing so did NOT work in my case, maybe it will work in your case. It’s worth a try!

Step 4: If you can, pay off that debt in full as soon as possible.

If the debt is accurate, you’ll likely want to pay it off as soon as you can to change the status from “unpaid” to “paid” on your credit report.

Believe me, I know how stressful and disheartening having a bill go to collections can be—especially when you had good credit before or when you were hoping to buy a home soon. But the sooner you can get it resolved, the sooner you can start building that credit back up again. I believe in you!

Thank you for the article. I’m in the same situation with Helvey & Assoc for an old Duke bill. I’ve also read that they won’t PFD, but it’s nice to see your credit score did improve after paying them.

Hey Jeff, I’m so sorry to hear you’re in the same situation. It stinks. But yes, there’s hope! My credit score continues to improve, so I just have to wait it out. Thanks for reading!

They r required to verify the debt I would have gotten the account number paid duke and then sue. They r suppose to validate before reporting. Oh wait I and doing that to them

Yep. Same exact situation. Duke energy, moved out of apartment, cancelled account, last payment somehow didn’t get paid. How do they do this?? so silly.

It’s maddening, isn’t it?? I’m so sorry this happened to you.